Resolve the TATA Sons IPO A Comprehensive Guide:

The banking industry is always changing, and businesses constantly adjust their strategies to grow and reach new markets. The TATA Sons IPO is one of those initiatives that recently generated interest from traders and investors. The announcement by the TATA Group, one of the most well-known companies in India, to go public with its holding company has generated a lot of attention and discussion. To fully understand the importance and possible advantages of the TATA Sons IPO.

Understanding Tata Sons:

TATA Sons is the main holding company of the TATA Group, a group of companies with a more than a century-long history. Since Jamsetji Tata was founded in 1868, the TATA Group has expanded into a global company with belongings in various industries, including steel, hospitality, information technology, automobiles, and telecommunications. TATA Sons is the promoter of several TATA Group companies and has strong ownership in several companies’ important divisions.

Tata Sons IPO:

The TATA Sons IPO of Tata Sons Limited, which is the principal holding company of the Tata Group. An initial public offering (IPO) is the process by which a privately owned company makes its shares available to the general public for the first time and becomes a publicly listed business. To go public, Tata Sons would have to list its stock on a stock exchange and make those shares available for purchase and sale by investors.

Because of the scope and status of the Tata Group, the Tata Sons IPO is going to be among the biggest in India’s corporate history. The demands related to its value, offering size, and possible effect on the Indian capital markets are high, and it has attracted a lot of interest from investors, analysts, and the media.

Key Highlights of the IPO:

- Offer Size: The TATA Sons IPO is expected to be one of the largest in India’s corporate history, with opinions regarding the exact offer size circulating in financial circles.

- Valuation: Valuing TATA Sons is a complex task given its multiple collections of investments and subsidiaries. Analysts will closely search the valuation methodology affected by the company and the pricing of the IPO to assess its attractiveness to investors.

- Use of Proceeds: TATA Sons plans to utilize the proceeds from the IPO to fuel its growth expectation, invest in existing businesses, follow strategic goods, reduce its balance sheet, and explore new opportunities in emerging sectors.

- Listing Venue: While the primary listing is expected to be on Indian stock exchanges, there may be considerations for secondary listings on international exchanges to attract a large base of investors and enhance liquidity.

Tata Sons IPO Date:

As of my last update in January 2022, there was an announcement for the Tata Sons IPO. According to the RBI rule Tata Sons, The holding company of multiple firms must be listed by September 2025 due to its upper-layer NBFC classification.

Tata Sons IPO Size:

Related to the Investment banking firm “Spark Capital PWM pvt.” the Issue Size of 55000 crore, it may get the valuation of Tata Sons IPO as 11 lac crore.

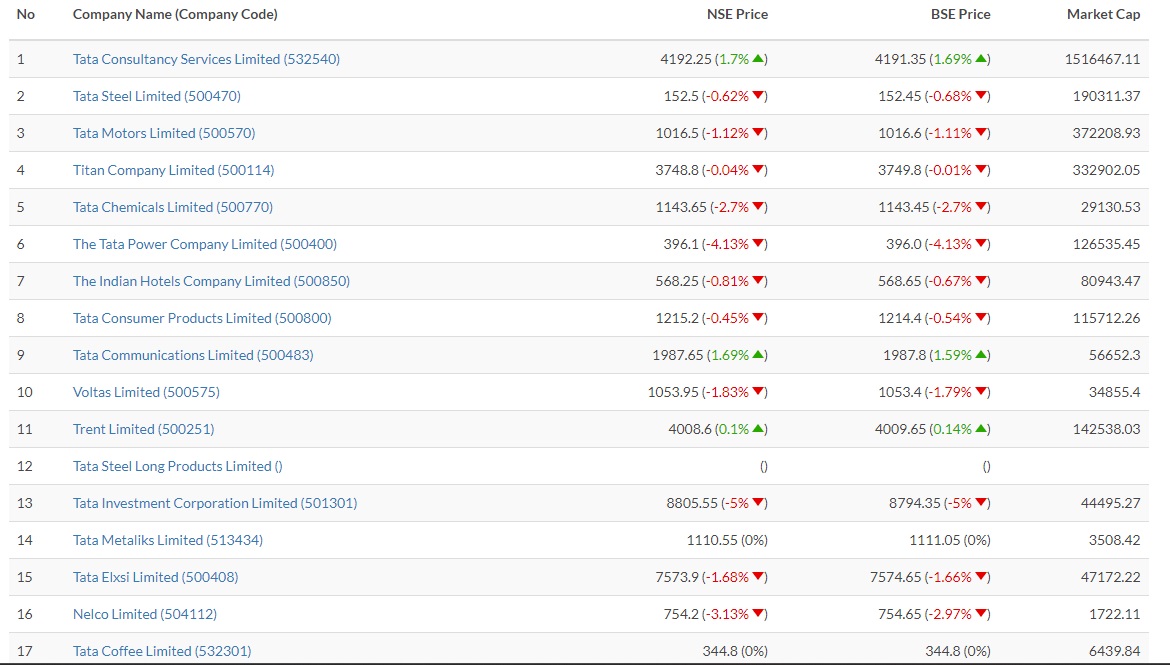

Tata Sons Stock Share Price:

Data Source: Tata.com.

Tata Sons Share:

Tata Chemical looks poor, and Tata Group stocks declined by 10%. The two maximum Shareholders of Tata Sons are Ratan Tata Trust and Sir Dorabji Tata Trust.

Tata Sons Shareholders List:

| Entity | Ownership Stake |

|---|---|

| Dorabji Tata Trust | 28% |

| Ratan Tata Trust | 24% |

| Tata Motors | 3% |

| Tata Chemicals | 3% |

| Tata Power | 2% |

| Indian Holdings | 1% |

How to apply for Tata Technologies IPO?

You can apply through both Online and Offline Mode. If you want to apply through offline mode then you can submit a form to IPO Bank or any Trusted Broker. Online mode is as easy as Offline mode.

Step to apply through Online Mode.

1. You can apply through the Tata Technologies IPO on the Trading App. or Deemat Account.

2. Log in with your details.

3. Then search and click on the Tata Technology IPO section

4. Then fill in all required Sections then Apply

5. after you can accept your price on the UPI app.

When Tata Technologies IPO be allotted?

Is Tata Technologies IPO good?

How “good” an IPO is will depend on several criteria, such as the company’s financial performance, growth potential, market circumstances, industry dynamics, and valuation. This is the best for investors who want to invest for a long time because all the companies of Tata Group are continuously growing.

Conclusion:

The TATA Sons IPO represents a significant milestone in the journey of one of India’s most iconic corporate houses. As investors await further details and disclosures regarding the offering, anticipation of the potential implications for the TATA Group, the broader market, and the investment landscape is rife. With its rich legacy, diverse portfolio, and ambitious growth plans, TATA Sons is poised to make waves in the capital markets, further cementing its position as a global leader in business and innovation.

Also Read This:- In 2024, Bajaj will Introduce the First CNG Bike.